Menu

- ONLY INSTITUTE IN SOUTH GUJARAT HAVING SKILL & KNOWLEDGE BASED TEACHING WITH 100% JOB GAURANTEE

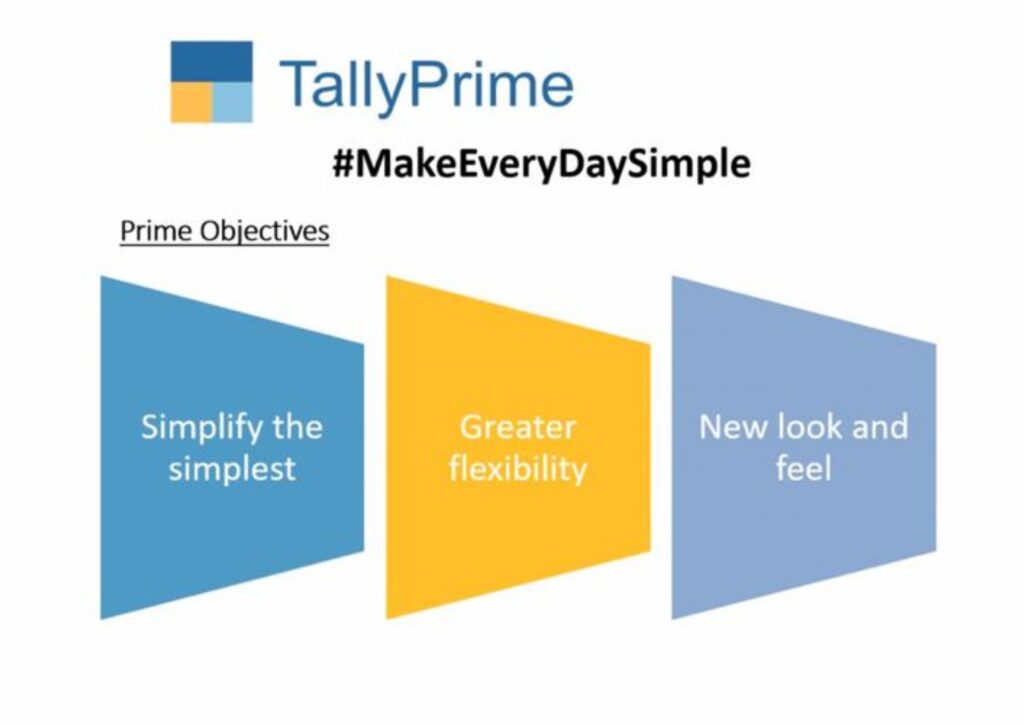

This program intends to make the participants experts in Tally PRIME in every aspect, so as to help in building his/her career. ટ્રેડિંગ, નોન – ટ્રેડિંગ અને મેન્યુફેક્ચરિંગ એકાઉન્ટ માટે ડિસ્પ્લે અને રિપોર્ટિંગ શીખવતી ગુજરાતની એક માત્ર સંસ્થા.

MODULE 1(NON-TRADING ORGANIZATION)

MODULE 2 (TRADING ORGANIZATION)

MODULE 3 (MANUFACTURING ORGANIZATION):

MODULE 4 (DISPLAY & REPORTING):

GOODS & SERVICE TAX (GST)

This course is designed in simple language, to give a clear and in-depth understanding of Tally PRIME with practical examples. We have taken instances of different industries such as trading, manufacturing, service, project based etc.